What to Expect When You Open a Bank Account

7/23/24 | Emily Knuteson, Relationship Banker

Did you just start a babysitting business or nail your first job interview? Are you finding that carrying a lot of cash is tricky and hard to keep track of? Well banks can help with all of that. With your first job comes your first paycheck, banks offer debit cards, bank accounts, and direct deposit services.

Banks, and their employees, take care of a handful of different things for customers including performing transactions for accounts, account maintenance when needed, and processing loans. This article will go through some of the basic transactions that happen at the bank including opening a new account and using your digital wallet.

Transaction Basics

Two basic transactions that banks handle is depositing money and withdrawing money. Deposits can be made by signing a check that was written to you, filling out a deposit slip at the bank and providing funds or the check to enter into your account. Checks can also be deposited through a mobile banking app. You can also transfer money from another account to deposit into your account.

Think of withdrawals as the opposite of deposits, they take money out of your account. This can happen by filling out a withdrawal slip, transferring funds, or cashing a check. When you are new to the bank it might seem tricky to know what to fill out or how to complete a transaction. Bank employees are here to help you figure it all out!

How to Fill Out a Check

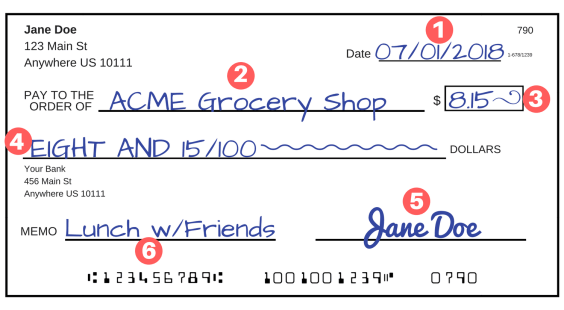

Here are some steps to help you fill out a check, deposit slip or a withdrawal slip. If you have questions or need clarification, just ask any bank employee to give you a hand!

- This is the date you are writing the check.

- This is the name of the person receiving the check. In this case, Jane Doe is writing a check to the grocery store.

- This will be the numerical amount of the check.

- This is the legal, or written, amount of the check. Make sure the numerical amount and this amount match because if it's different, the bank will have to go by what the legal amount says.

- This is where you sign after you have written the check.

- This is typically where a comment goes on the check, letting you and others know why you wrote the check. This is optional.

Why Do I Need Checks

With all of today’s modern technology and online banking, you may be asking why you would write a check. Checks can be used to perform transactions, pay other people, pay bills, and send payments for fees. Even if you don’t plan on using them, it is always important to know how to use a check!

Setting Up a New Account

Bank employees can help you open new accounts and perform maintenance on accounts. When opening a new account some banks require legal documents. It is always best to stop by or call to verify that you are bringing what is needed to correctly and efficiently open your account. For example, as a minor you might need two forms of verification like your Social Security Number, school ID card, a driver’s license or a passport. After you have the correct documents, the bank usually offers a couple different account types for you to choose from. There are a variety of accounts so you can find one that best suits your banking needs. After you decide what account type works best for you, the bank employee opens your account and walks through any disclosures or account add-ons.

Your Account Add-Ons

The most requested add-on is a debit card for a checking account. After you fund a checking account, you can request to receive a debit card. A debit card works differently than a credit card.

Debit cards are linked to your checking account and pulls from the funds that you have available in that account. To use a credit card, you borrow money from the card issuer as a loan. After you use a credit card, you must pay back what you spent and may be required to pay interest on the used funds if you don’t pay the monthly balance. After you use a debit card, a transaction history is stored and can be viewed through your banking app or on your account statements. Debit cards can be used almost everywhere, including at ATMs to withdraw money from your account.

ATMs are “automatic teller machines” that electronically allow you to perform basic banking transactions, like a withdrawal from your account without the presence of a bank employee. However, when you use an ATM there may be a service fee associated with your transaction if you use an ATM at a bank where you do not have an account. When you go to the bank instead of the ATM, there is typically no service charge for your transactions.

When you open an account, you also have access to the mobile banking app which can be a part of your digital wallet. The banking app allows you to keep track of balances in your account, lock your card if needed, view transaction histories on accounts, and allows you to transfer money between your accounts. In addition to your mobile banking app, digital wallets include money apps like Venmo, PayPal, and your phone’s “wallet” where you can store your card information if wanted. These money apps are provided by a third-party vendor, not your bank. When opening your account and enrolling in online banking please ask questions to make sure you understand the banking app and can use it with ease.

Banking may seem overwhelming, but bank employees are always there to help. Please feel free to stop by any of our branches to ask about transactions, our mobile app, opening an account, questions about your debit card, or even your digital wallet. We are here to help you get the best banking experience.

ABOUT THE AUTHOR

Emily Knuteson is a Relationship Banker at Altabank. She loves exploring marketing concepts and leaning more about the world of banking.